Understand the Rules of the Road for Compliance in Federal Government Contracting

Understanding IT compliance requirements and certifications is crucial for government contractors and how you can navigate the “rules of the road” for successful and compliant federal contracting. Federal agencies require contractors to follow IT compliance standards to protect sensitive information, ensure data integrity, and meet specific security protocols. An inability to comply with these standards can be a barrier to entry in the federal market. Failing to meet these standards in existing contracts can lead to rejected bids, costly fines, loss of contracts, or even legal action.

In addition to regulatory requirements, there are a myriad of IT-related certifications. However, it’s not necessary, or possible, to get every certification before you to go market. It will be an ongoing conversation with prospective and existing customers about which ones to pursue and along what timeline.

Federal IT Standards

- FAR, DFARS, and Beyond

When it comes to federal contracting, two of the most critical regulatory frameworks are the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). The FAR outlines the general compliance requirements for federal contractors, while the DFARS goes a step further with additional cybersecurity requirements for DoD contractors.

The National Institute of Standards and Technology (NIST) has developed a suite of guidelines that serve as the foundation for IT compliance in federal contracting. The FAR and DFARS refer to some of these NIST guidelines through specific clauses that mandate safeguarding procedures for federal data. For instance, DFARS Clause 252.204-7012 outlines security requirements for handling controlled unclassified information (CUI) on contractor information systems. Contractors must comply with standards such as NIST SP 800-171 to secure sensitive data and avoid unauthorized access.

- Protecting Federal Data: CUI and CMMC

Contractors working with federal agencies may be required to handle Controlled Unclassified Information (CUI), which encompasses sensitive information that needs safeguarding but does not meet the criteria for classified information.

For instance, the NIST SP 800-171 control set is the foundation for Cybersecurity Maturity Model Certification (CMMC) and is specifically designed for non-federal information systems that handle CUI, covering 110 security requirements across categories like access control, incident response, and risk assessment. By implementing NIST guidelines, contractors not only meet regulatory requirements but also strengthen their own cybersecurity defenses against potential threats.

- The Role of CMMC

CMMC is a recent addition to the IT compliance landscape for federal contractors, especially those working with the DoD. CMMC is a cybersecurity framework that requires contractors to demonstrate their cybersecurity practices through independent audits. Contractors must achieve the appropriate certification level to bid on certain DoD contracts.

Understanding CMMC is crucial because it directly impacts contractors’ eligibility. If a contract requires a specific level of CMMC certification, failing to obtain that level will disqualify the business from the bidding process.

- Protecting Federal Information Systems: FISMA, RMF, and ATO

Compliance with Federal Information Security Management Act (FISMA) standards is often required for systems developed on behalf of, or to be used by, the federal government.

To comply with FISMA, contractors must implement information security controls within those systems that align with the NIST Risk Management Framework (RMF) and perform regular security assessments based on the assigned categorization level. Non-compliance with FISMA can impede the developed system from getting an Authorization to Operate (ATO).

ATO is the security approval to launch a new IT system in the federal government and the requirements can vary agency by agency. Obtaining an ATO can take days, weeks, months, or a year+.

- Protecting Cloud Information Systems: FedRAMP

Cloud service providers entering the federal market must understand the Federal Risk and Authorization Management Program (FedRAMP), as it is a critical compliance framework for offering cloud services to U.S. Federal agencies. The purpose of FedRAMP is to ensure that cloud services meet strict security requirements to protect federal data. Without FedRAMP authorization, most federal agencies cannot legally use your cloud product/service.

Key Steps to Ensure Compliance: Practical Tips for Federal Contractors

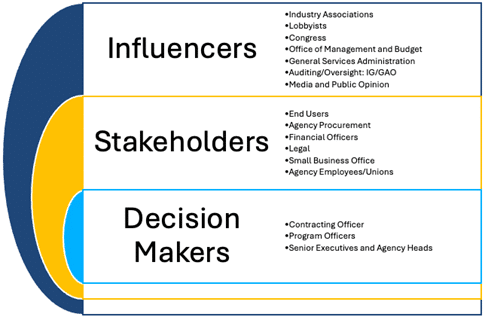

Given the complexity of federal IT and the associated certifications, requirements, and trends, staying on top of what is a “must have” and what is a “nice to have” can be a challenge. In some cases, the way forward will be guided by ongoing conversations with prospective and existing customers about which ones to pursue and when. In other cases, federal laws and regulations dictate what’s required. Here are a few strategies to help contractors stay compliant:

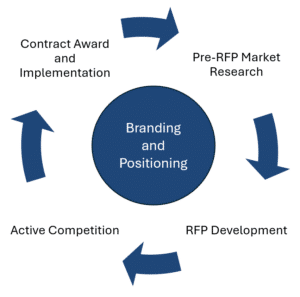

- Understand the Market: Any go-to-market strategy should include steps needed to address any security compliance requirements.

- Regularly Review Regulatory Updates: IT compliance requirements evolve frequently, especially in federal contracting. Keep a close eye on changes to FAR, DFARS, and CMMC requirements to ensure that your organization remains compliant.

- Invest in Cybersecurity Training: Educating employees on cybersecurity best practices and compliance requirements is essential. Many security breaches are caused by human error, so training employees to recognize threats and follow protocol can significantly reduce risks.

- Perform Internal Audits and Assessments: Conduct regular compliance audits to assess your company’s cybersecurity practices and identify any vulnerabilities. By identifying weaknesses before an external audit, you can make improvements and ensure that your systems meet federal standards.

- Partner with IT Compliance Experts: For many contractors, especially smaller businesses, the complexity of IT compliance can be overwhelming. Partnering with compliance experts or managed security providers can help you navigate regulations more effectively and implement necessary security controls.

Understanding the IT requirements for market entry and growth in federal contracting is essential to building trust with government clients and positioning your business for success. From FAR and DFARS to CMMC and FISMA, federal IT compliance requirements ensure that contractors can protect sensitive information and meet the government’s security standards. By investing in cybersecurity, staying informed on regulatory changes, and taking proactive steps to ensure compliance, contractors can avoid the risks of non-compliance and confidently pursue federal contract opportunities.

About the authors

MJ Sivulich is a Senior Vice President and leads Jefferson’s business solutions practice. MJ provides federal business development, capture, proposal, government affairs, and market research support to industry clients. Contact MJ to learn more about Jefferson’s federal business development services, such as information on go-to-market strategy solutions, including IT requirements, please email contact@jeffersonsg.com.

Lisa Wallace is the President and CEO of Stanton Secure Technologies (SST), leads a dedicated team that provides exceptional cybersecurity compliance services. SST is your trusted partner in developing and implementing effective risk management and security programs, conducting thorough assessments, and ensuring that you meet compliance standards. If you’re seeking tailored solutions for NIST, FedRAMP, CMMC, or ISO to protect your organization, please email info@sst-llc.com.